The Market Is Changing: Buyers Are Gaining Leverage as Listings Rise

If you’ve been keeping an eye on the real estate market, you’ve likely noticed a shift — and this one’s leaning in favor of buyers. After years of an aggressive seller’s market, we're starting to see a much-needed balance return to the playing field. With inventory climbing and price cuts becoming more common, today’s buyers are stepping back into the market with stronger bargaining power.

Listings are up — and so is Buyer confidence

Nationwide, more homes are hitting the market than we’ve seen in recent years. Inventory levels are up 20% from this time last year and even surpass levels seen in August 2020. What does this mean for you as a buyer? Simply put: options. More inventory gives buyers breathing room, leverage to negotiate, and better chances of finding the right home without being pushed into a bidding war.

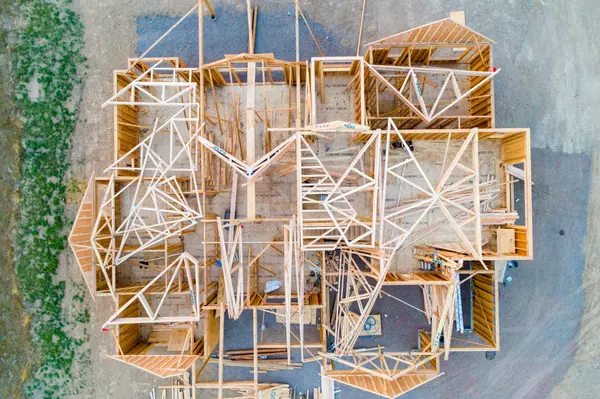

Even in high-growth areas like the South, where homebuilders have responded to increased demand, we’re seeing a swell in listings. However, rising insurance costs in states like Florida, Louisiana, and Texas are also nudging more homes onto the market, which, again, translates into more opportunity for buyers.

Price Cuts Are on the Rise

As inventory increases, so does competition among sellers. That’s leading many homeowners to adjust their listing prices downward in order to stay competitive. In March alone, nearly 34% of all homes listed on Realtor.com had a price cut. That's a big jump, especially considering even during the peak of the pandemic, only about 18.7% of listings saw a reduction.

Now, to be clear, a price cut doesn’t always mean a bargain — sometimes sellers price high intentionally to leave room for negotiation. But in a market with more comps and more active listings, overpriced homes don’t sit pretty for long. Sellers have to be realistic, and that benefits serious buyers.

What About Affordability?

While prices are still historically high, the good news is that affordability has slightly improved. Mortgage payments today are about 1.3% lower than they were a year ago, and mortgage rates are sitting around 20 basis points below 2023 levels. It's not a dramatic drop, but every bit helps — especially for first-time buyers.

At the same time, though, don’t overlook the rising cost of homeownership beyond just the sale price. Homeowners' insurance premiums have surged, rising nearly 9% faster than inflation between 2018 and 2022. Property taxes have also jumped in many areas. These are the real numbers that affect your monthly budget, so it’s crucial to take a holistic view of affordability.

A Silver Lining for First-Time Buyers

If you’ve been renting and watching from the sidelines, this shift might be your moment. As sellers become more flexible and the market cools slightly, that wide gap between buyer and seller expectations is beginning to close. For the first time in a while, first-time buyers are seeing a more level playing field, especially with more choices and greater room to negotiate.

But don’t expect a full buyer’s market just yet. We’re still in a transition period, and nationally, sellers still have a slight edge. However, things are clearly changing — and it’s wise to get prepared.

My Advice: Don’t Try to Time the Market

One of the most common questions I get is: “Should I wait for rates to drop?” The reality is — no one has a crystal ball. Waiting on the Fed to make a move, or for mortgage rates to dip dramatically, can backfire. In fact, when the Fed cut rates last year, mortgage rates increased due to market volatility and Treasury yield fluctuations.

Instead, focus on what you can control: your finances. Understand your budget, get pre-approved, and know how current mortgage rates affect your monthly payment. When you find the right home that fits your budget and your needs, that’s your green light, not some hypothetical future rate drop.

Final Thoughts

We’re entering a more balanced market, and that’s a good thing for everyone. If you're thinking about buying, now is the time to start getting serious. Whether you're a first-time buyer or looking to move up, having the right strategy (and the right agent) makes all the difference.

If you’re curious about how these trends impact your local market or want help evaluating your options, feel free to reach out. I’m here to help you make smart, informed decisions every step of the way.

The information contained, and the opinions expressed, in this blog are not intended to be construed as investment, legal, or financial advice. Franck Munana and CrestPoint Capital Estates LLC do not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing in this publication should be interpreted as personalized investment guidance. Readers are advised to conduct their own independent research and due diligence and to seek advice from a qualified professional before making any real estate or financial decisions. Franck Munana and CrestPoint Capital Estates LLC shall not be held liable for any loss or damage arising directly or indirectly from the use of or reliance on the information or opinions presented in this blog.

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "