Why the Tariff Rollback could be good news for the lagging market

It’s no secret that this spring’s real estate market has been off to a slow start. With inflation lingering, interest rates hovering near 7%, and consumer confidence on shaky ground, many buyers have been hesitant to make a move.

But there’s a silver lining on the horizon.

On May 12, the U.S. and China agreed to a 90-day tariff rollback, easing tensions in the trade war and significantly reducing tariffs on both sides. The U.S. will drop its tariffs on Chinese goods from 145% to 30%, while China will cut its tariffs on U.S. goods from 125% to 10%.

That announcement sparked an immediate rally on Wall Street—the Dow surged over 1,000 points, and real estate stocks jumped 3–5%. And while this may seem like financial news for investors, it actually has very real implications for everyday homebuyers and sellers.

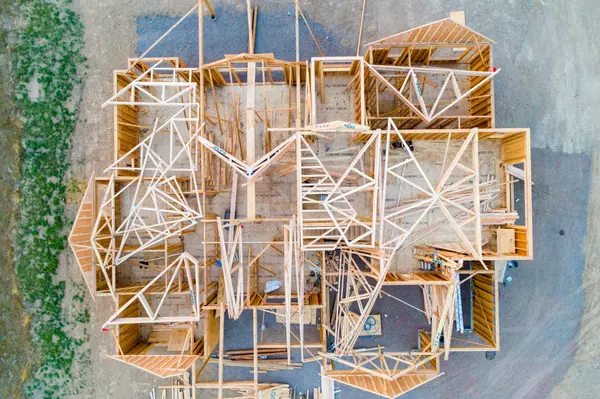

1. Tariff Rollback = Lower Costs for Homebuyers

When tariffs are high, the cost of building materials and home appliances goes up—and those extra costs often get passed down to the buyer. This rollback has the potential to reduce:

•Construction and renovation costs

•Appliance and fixture prices

•Pressure on supply chains

That could improve affordability in the months ahead and make homeownership just a little more attainable for buyers on the fence.

2. Confidence is Key in Real Estate

When people feel unsure about the economy or their finances, they tend to hit pause on big decisions, like buying a house. But now that portfolios are seeing gains and inflation could be easing, confidence is slowly starting to return.

“When consumers do not feel confident, they are less likely to make a major financial decision like purchasing a home,” said Joel Berner, a senior economist at Realtor.com.

This kind of rebound in consumer sentiment can have a powerful ripple effect, especially in markets like Atlanta, where buyers have been waiting for more favorable conditions.

3. A Chance for Lower Rates Down the Line

It’s true that mortgage rates have ticked up slightly this week, currently averaging around 6.92%. That’s a reflection of the short-term market reaction. But here’s the upside:

By easing tariff pressures and potentially reducing inflation, the Federal Reserve could have more room to lower interest rates later this year. That would make borrowing cheaper and create more momentum in the housing market.

4. Signs of Life Already Showing

Despite a sluggish start to the season, we’re starting to see movement:

•Mortgage applications jumped 11% last week

•Home tours are up compared to this time last year

•Buyers are beginning to re-engage as confidence slowly builds

This isn’t a full turnaround just yet, but it’s a positive sign that buyers are still out there, watching and waiting for the right moment.

Final Thoughts

From my perspective as a local agent and investor, this is the kind of news that helps turn hesitation into action. The housing market runs on confidence, and this tariff pause is an important step toward stability.

If you’ve been waiting for the “right time,” this could be it. Whether you’re buying, selling, or just exploring your options, now’s a good time to revisit your strategy. The market may still be finding its balance, but opportunities are opening up for those ready to move with clarity.

If you’d like to talk about how this might affect your buying or selling plans, feel free to reach out. I’m always here to help you navigate the market with confidence—no pressure, just real conversations.

Web: franck.findatlantahomelistings.com

The information contained and the opinions expressed in this blog are not intended to be construed as investment, legal, or financial advice. Franck Munana and CrestPoint Capital Estates LLC do not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing in this publication should be interpreted as personalized investment guidance. Readers are advised to conduct their own independent research and due diligence and to seek advice from a qualified professional before making any real estate or financial decisions. Franck Munana and CrestPoint Capital Estates LLC shall not be held liable for any loss or damage arising directly or indirectly from the use of or reliance on the information or opinions presented in this blog.

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "