Is Waiting for 3% Mortgage Rates the Right Move? Here’s What I’ve Been Seeing

Lately, I’ve had more and more conversations with renters and first-time buyers who tell me the same thing: “I’m just going to wait until mortgage rates go back down, maybe around 3%, before I think about buying.”

That’s a totally valid concern. In fact, a new report from BMO backs this up, showing that nearly 1 in 4 potential buyers are holding off on buying until rates fall below 3%—even though economists are saying that’s not likely to happen any time soon.

But here’s what I’ve been thinking (and talking about with clients): Is waiting for that perfect rate helping, or could it be holding you back?

The Bigger Picture

According to the report, 67% of adults say mortgage rates are affecting their buying decisions, especially millennials and Gen Zers. That tracks with what I’ve seen talking with younger buyers here in Atlanta—many feel stuck between high rates and high prices.

But while it’s tempting to wait for the "just right" rate, I always remind people: real estate is about more than just rates. It’s about building equity, planting roots, and creating financial stability over time.

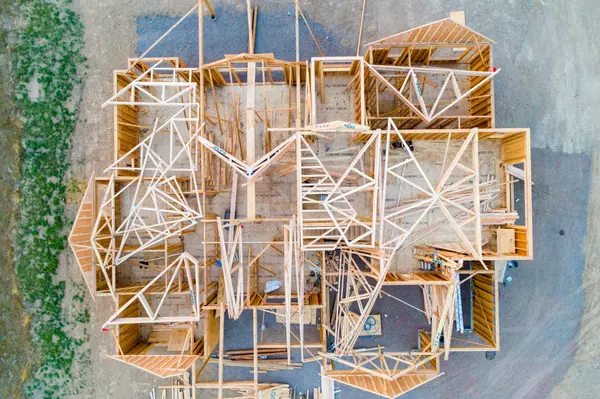

Right now, people are also second-guessing the idea of “starter homes.” Nearly 60% of respondents said it doesn’t make sense anymore to buy a starter home and trade up later. I get that. It’s why I work hard to help clients find homes that feel long-term—properties with solid potential, even if they need a little work.

Renting Feels Easier—But Is It?

The survey also found that over half of non-owners feel content continuing to rent. I’ve talked with folks who appreciate the flexibility renting brings, especially in uncertain economic times. But at the same time, Gen Z buyers seem more motivated than ever to get into the market, despite affordability challenges.

It’s that drive I admire and try to support. Because the truth is, even if you’re not ready today, this is still a great time to start planning—whether that means improving credit, learning about different loan options, or just figuring out what’s realistic for your situation.

Looking Ahead

The report points to a potential increase in home sales starting in 2026, which is promising. But here’s something I always share with clients: waiting for the “perfect time” can sometimes mean missing out on the right opportunity today. Yes, some buyers are sitting tight, but that also means less competition right now. If you’re in a position to start exploring, planning, or even buying, this could actually be a smart window to move while others are on the sidelines. No one can perfectly time the market, but you can prepare, make informed decisions, and move when it feels right for you. Whether that’s now or in the coming months, I’m here to help you think it through.

Final Thoughts

Buying a home doesn’t have to mean rushing. It’s about being ready—not just financially, but mentally and emotionally. If you’ve been thinking about stepping into the market, but you're unsure whether it's the right time or what steps to take first, I’d be happy to help guide you.

Web: franck.findatlantahomelistings.com

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "